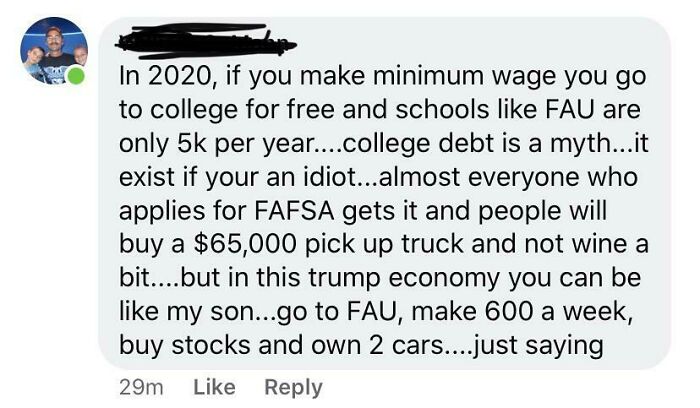

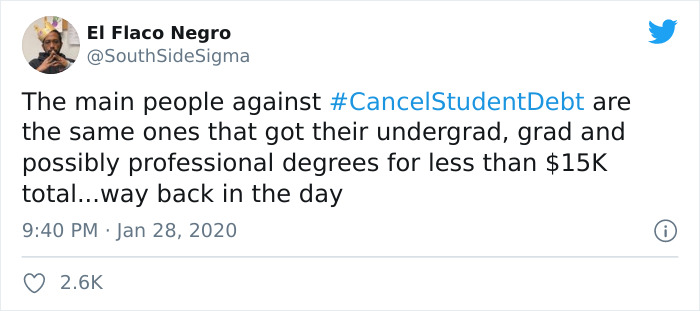

There are 45 million Americans who collectively owe $1.71 trillion in student loans. And it’s no secret that the financial burden of it negatively affects the lives of many former students with education finished and unfinished, in profound ways. From mental health to home-buying, student loans are somewhat of an ever-present shadow looming over for many years to come.

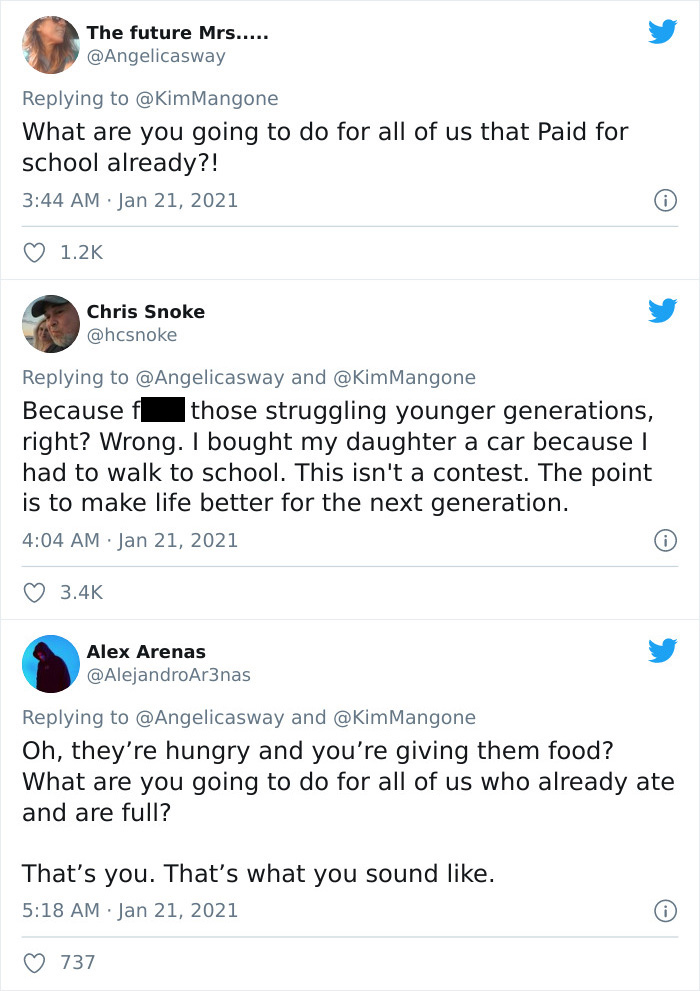

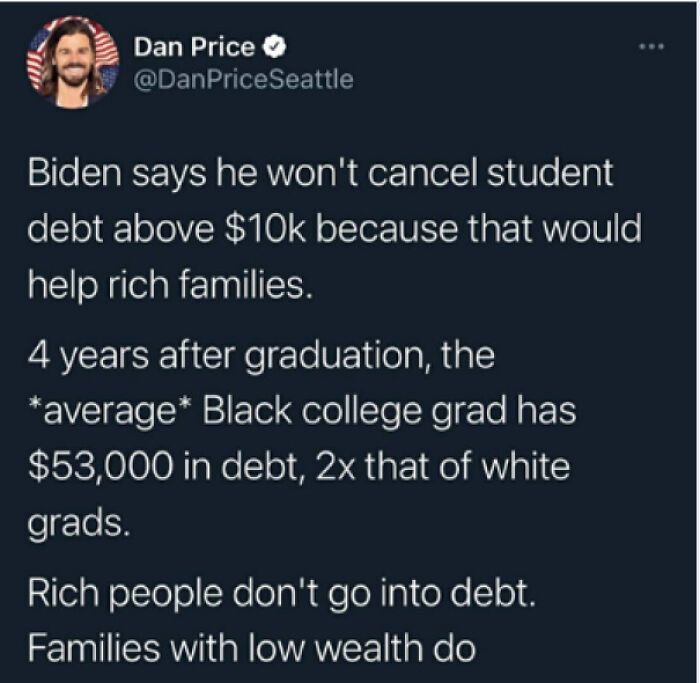

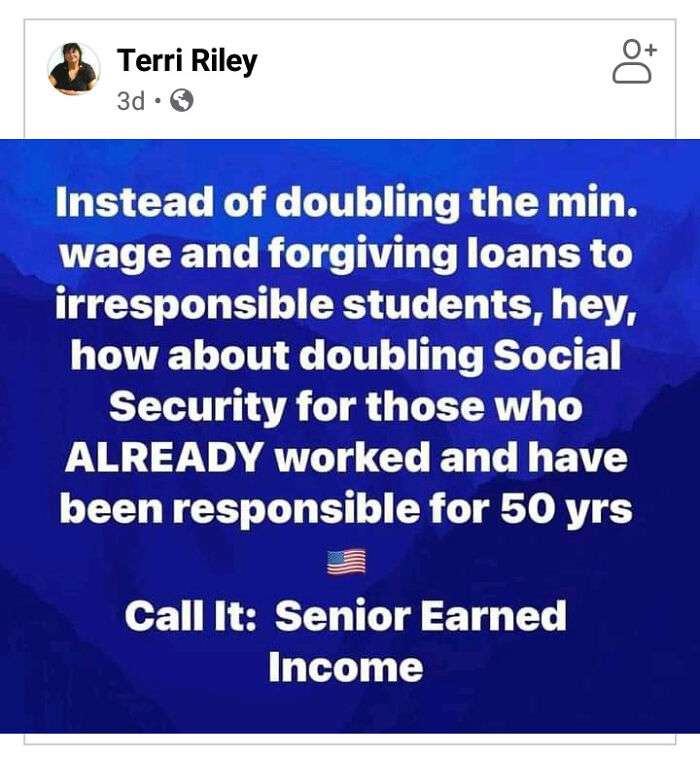

But President Biden has recently given hope to many by ordering Education Secretary Miguel Cardona to prepare a report on the president’s legal authority to cancel up to $50,000 in student debt per borrower. The possibility of Biden forgiving student loans has surely ignited a heated debate on this sensitive, and often sour subject matter.

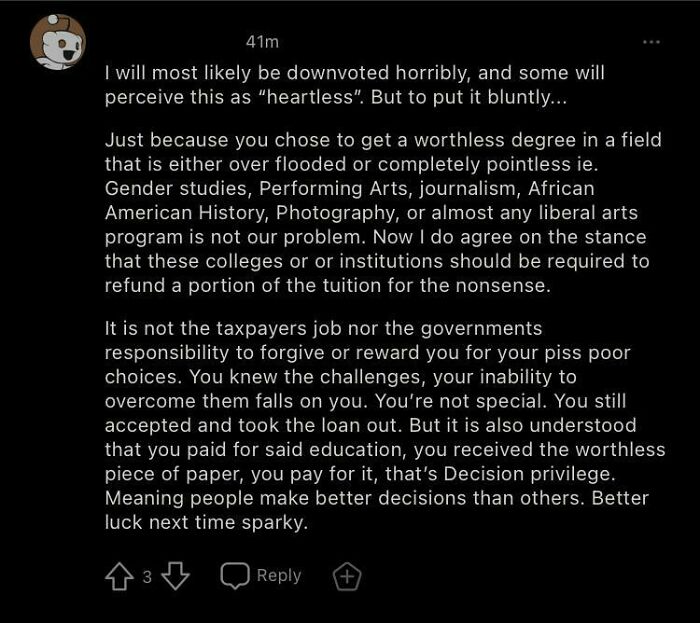

And while for many American borrowers, the prospect is more than just politics, giving a sense of long-awaited salvation, others have expressed arguments against it. They claim that simply wiping clean the debt is not a solution for the economy and equity. Which side are you on? Hit us in the comment section below!

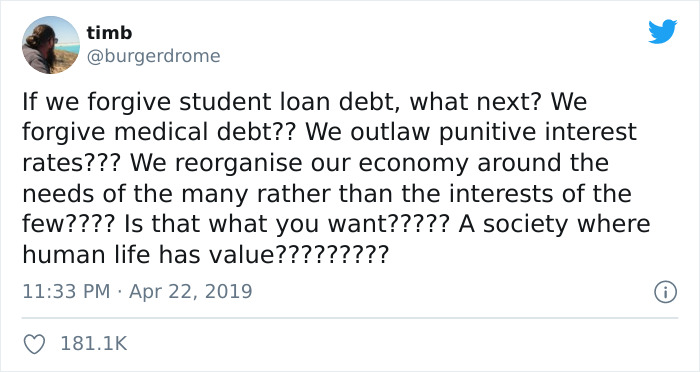

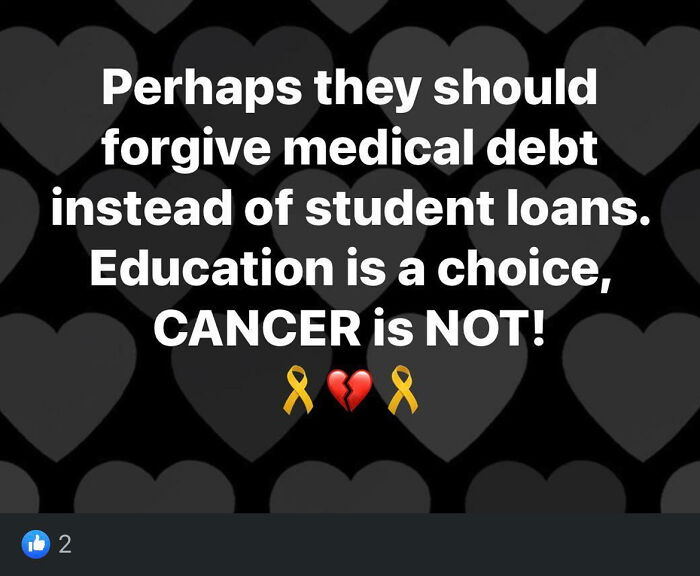

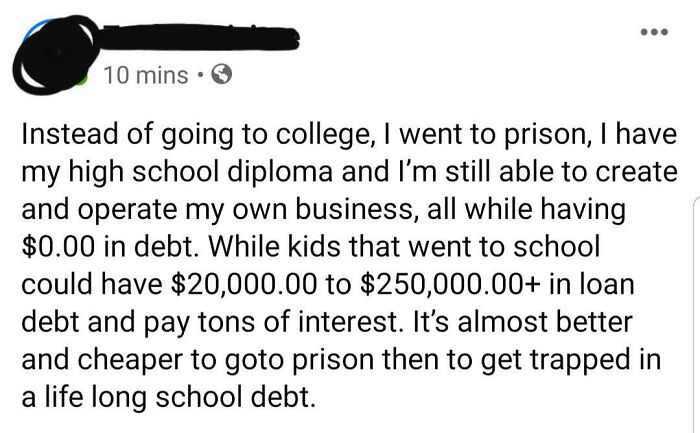

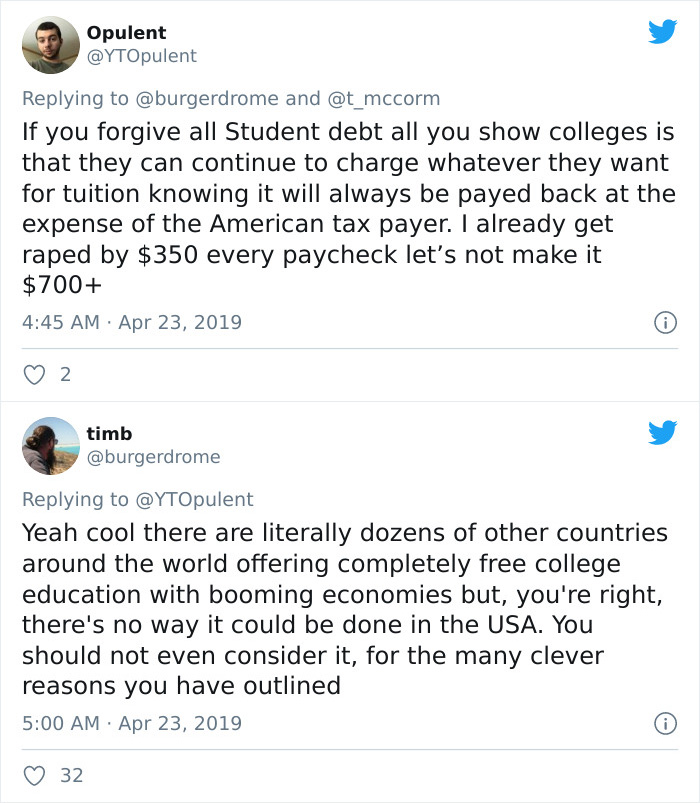

#1

Image credits: burgerdrome

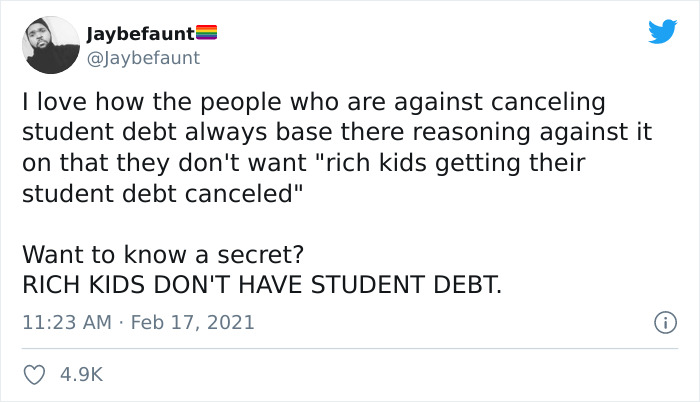

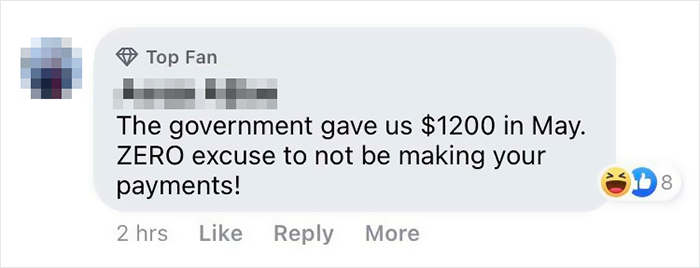

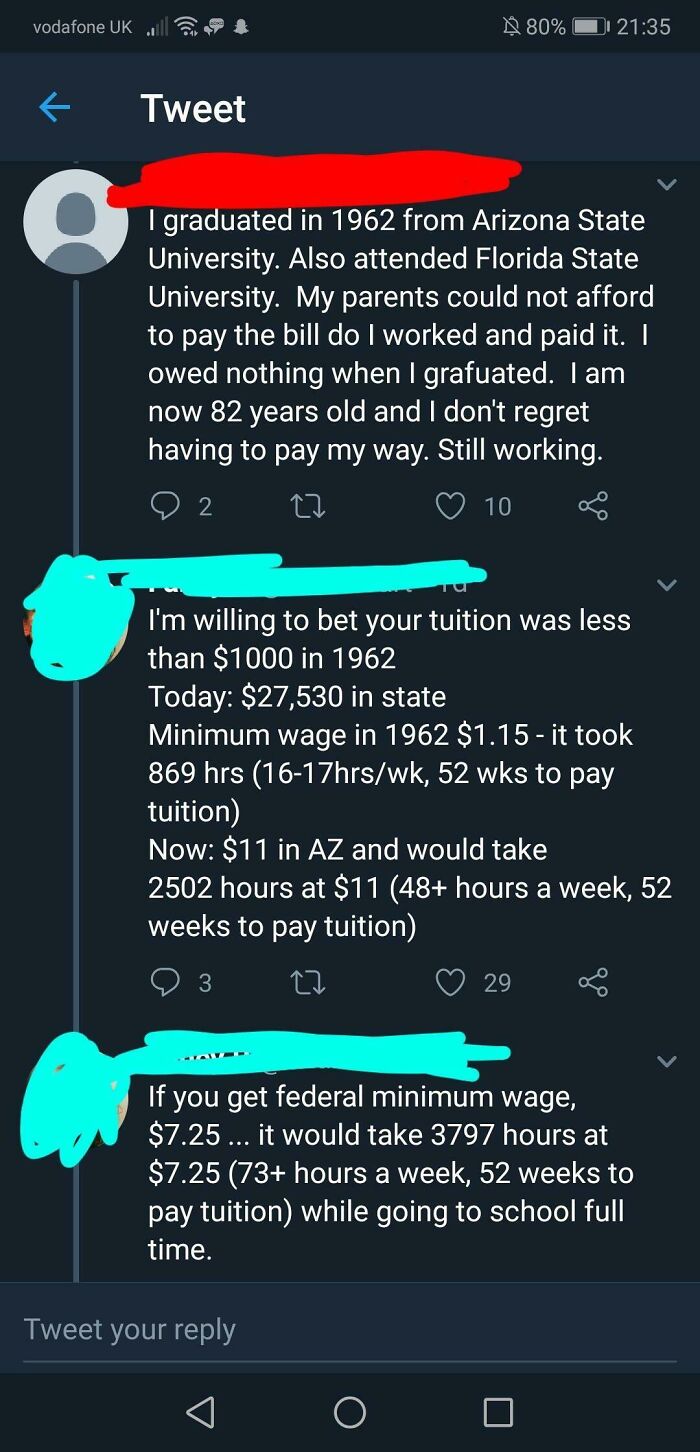

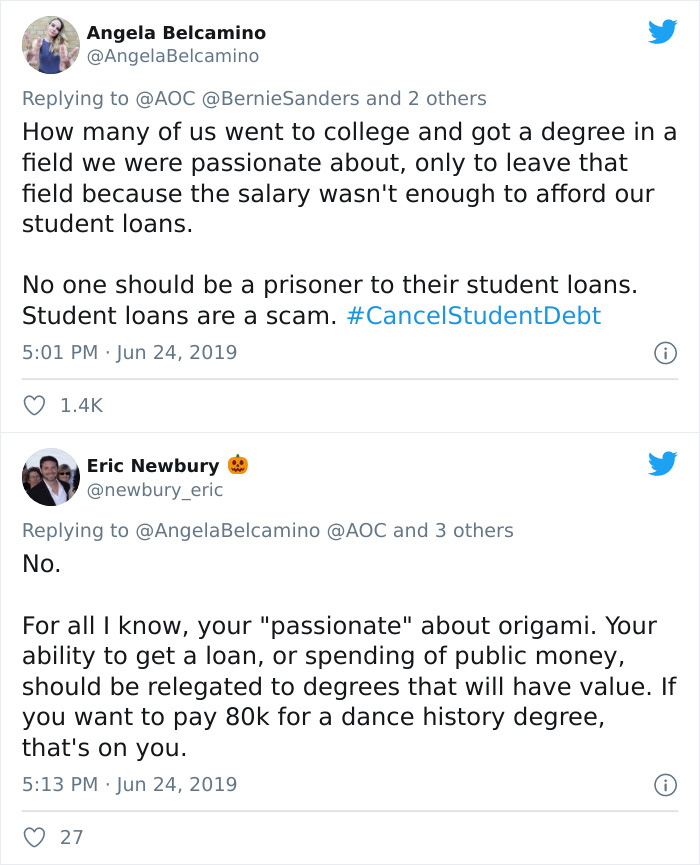

#2

Image credits: Jaybefaunt

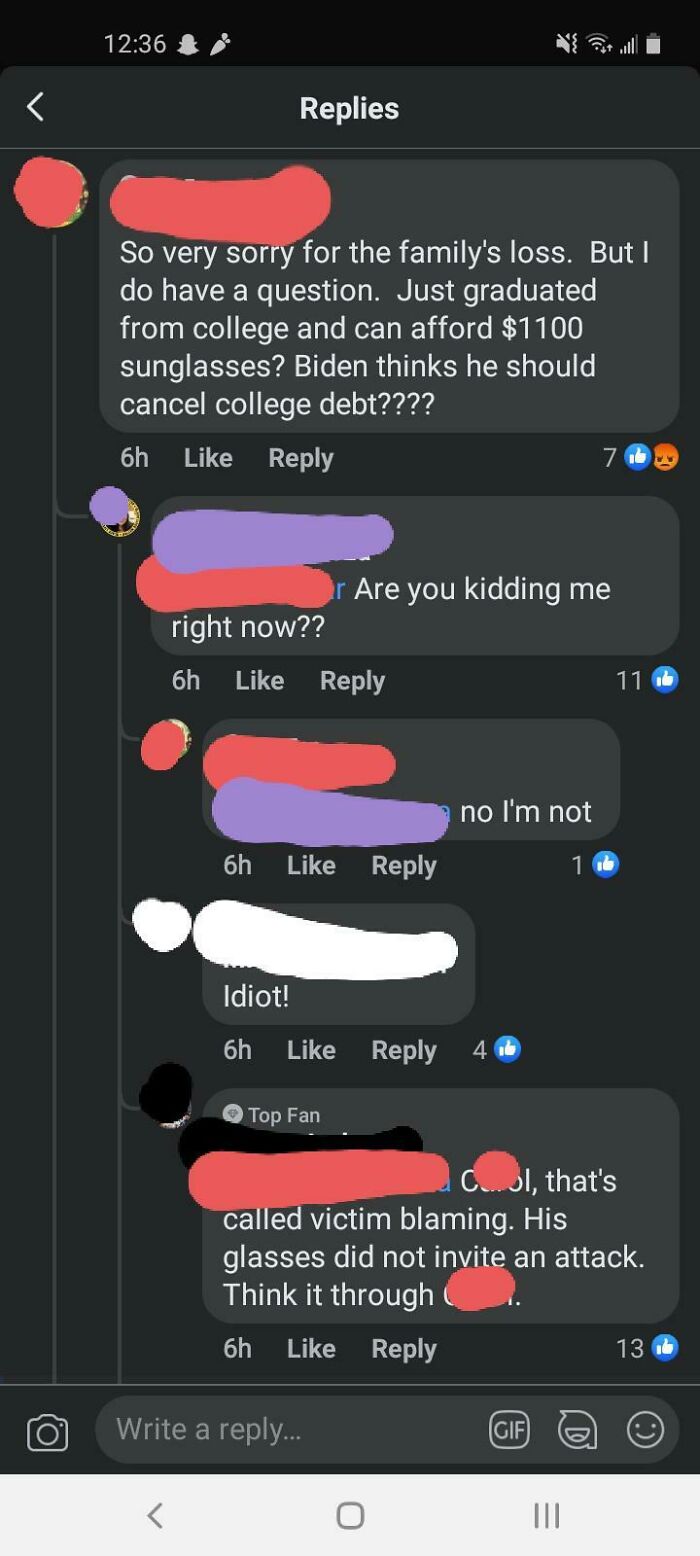

Nearly 45 million Americans now owe a total of $1.7 trillion in federal and private student loans, for educations both finished and unfinished. The scale of the problem is undeniable in terms of the effects it takes on people's mental health, quality of life, and overall wellbeing.

Now that President Biden has officially stated that he supports forgiving $10k of student loan through legislative action, many Democrats think it’s not nearly enough. Some claim the federal debt forgiveness could easily reach $50k per borrower, and some go as far as saying to erase all the amount altogether.

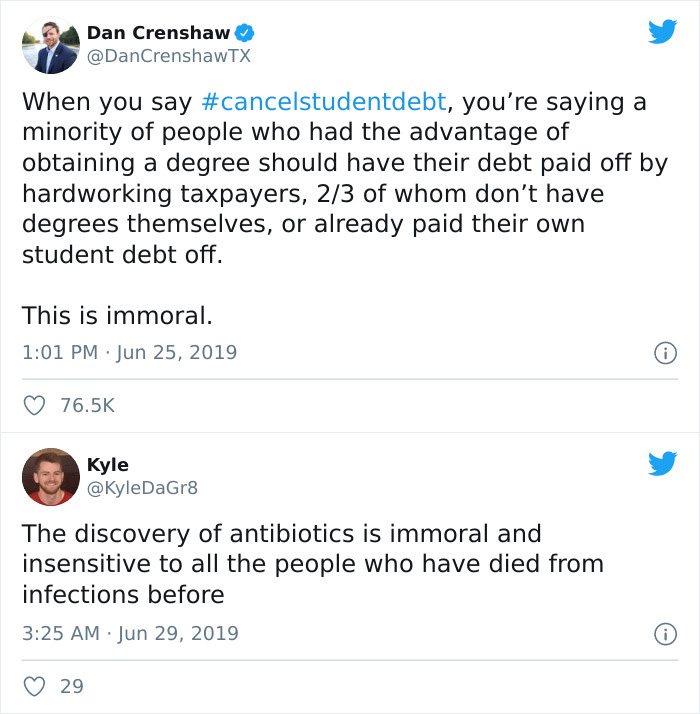

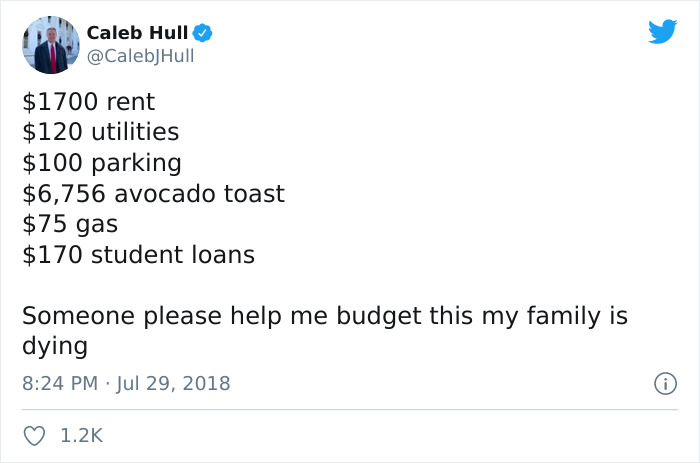

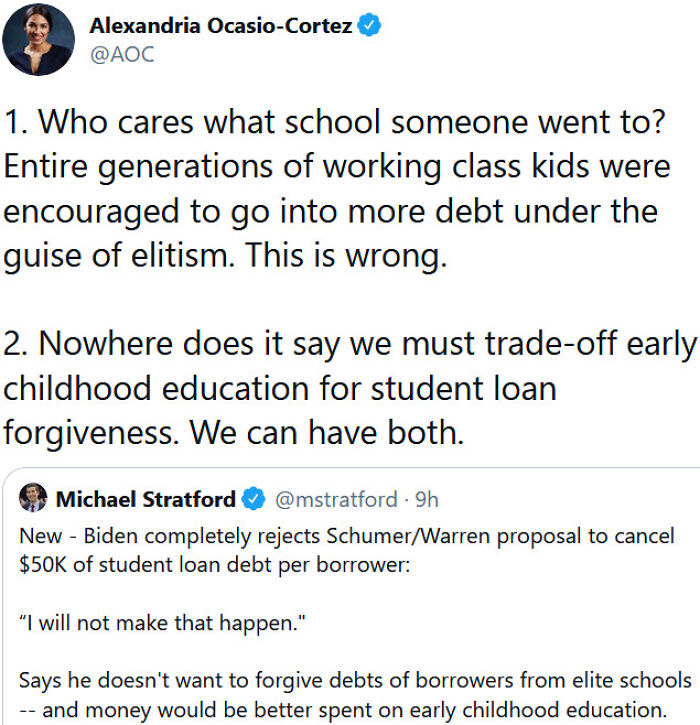

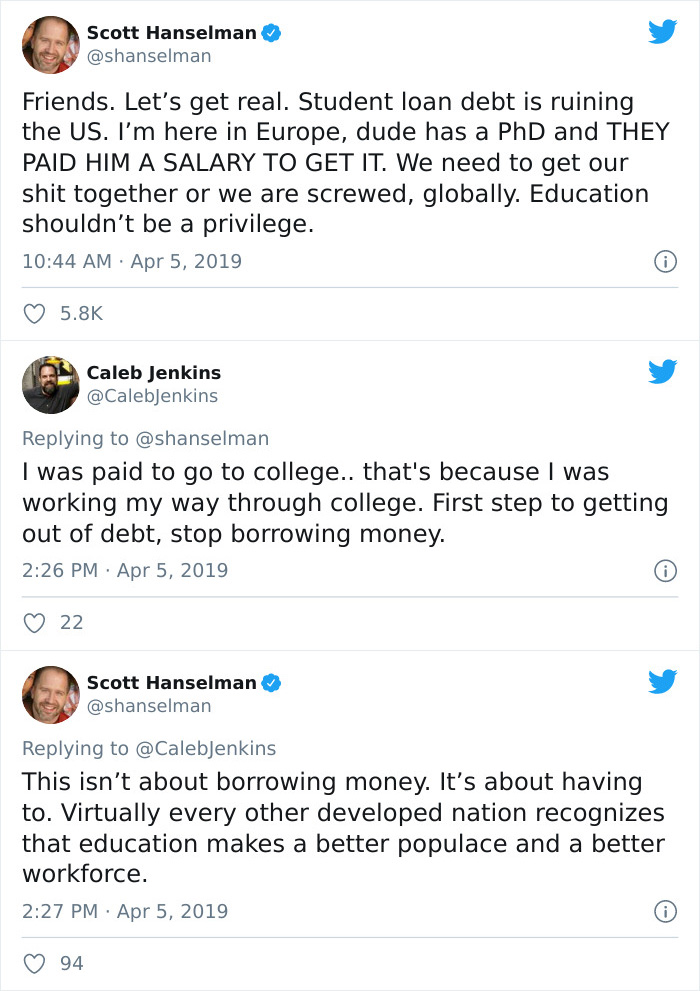

#3

Image credits: KyleDaGr8

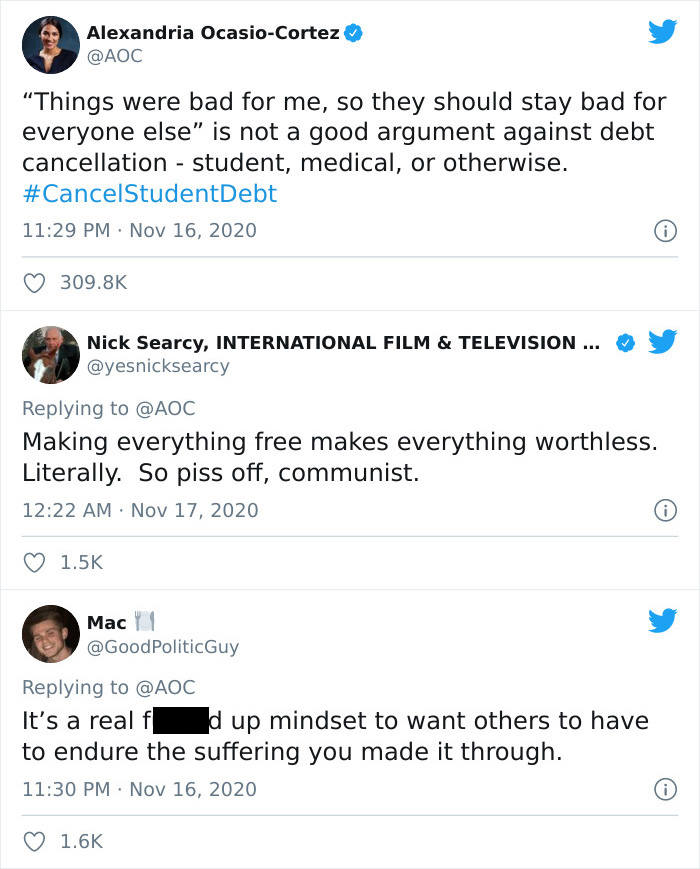

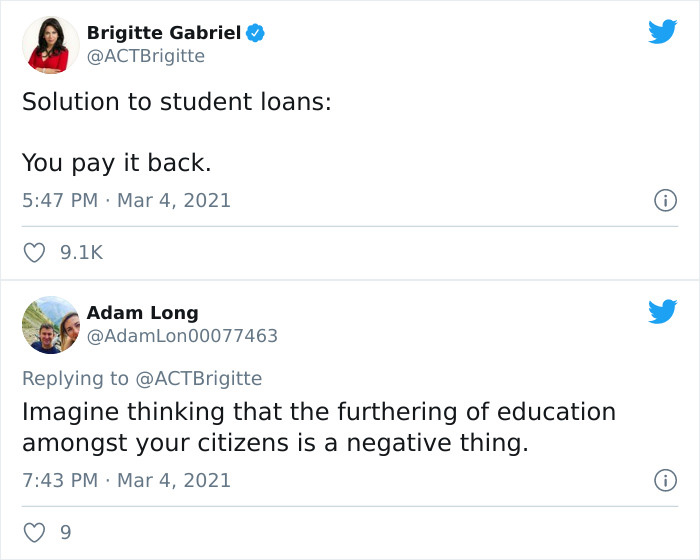

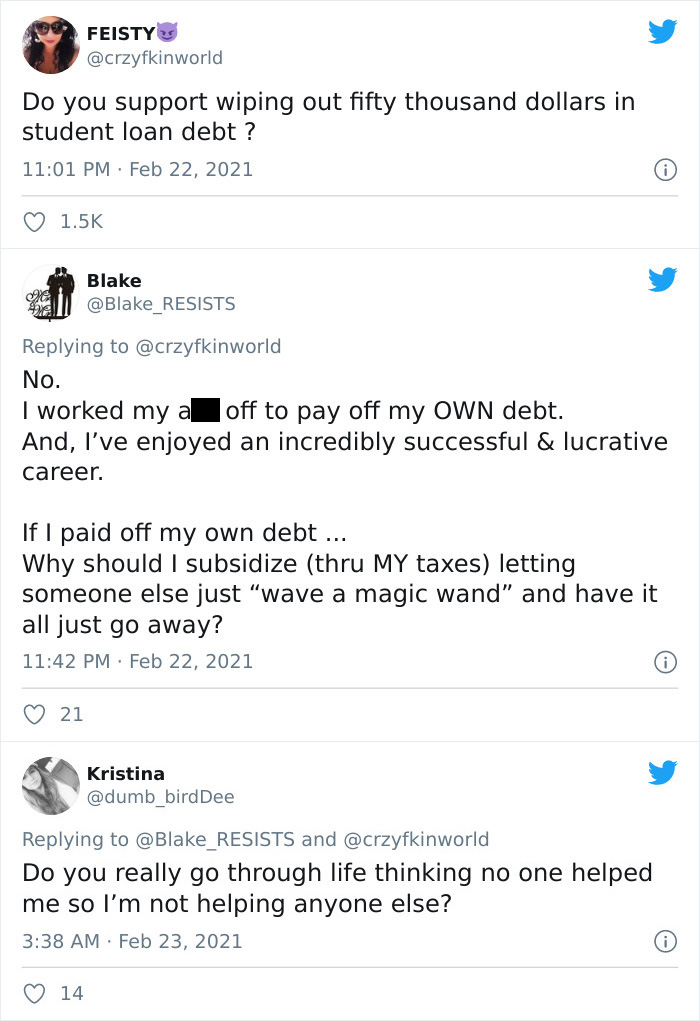

#4

Image credits: GoodPoliticGuy

In an interview with Vox, Laura Beamer, lead researcher on higher education finance at the Jain Family Institute, said that it’s abundantly clear that “people with student debt are less likely to own a house, they’re less likely to start a business, they’re delaying normal financial life cycles than previous generations past.”

#5

Image credits: antonydavies

#6

Image credits: kyry5

For many previous generations, starting a family and saving for retirement were natural life decisions, but student loan borrowers don’t feel like they have the luxury of doing so. “We also know that people 50 and above are the fastest-growth student debt loan-accruing debt group, because they’re taking loans out for their kids or their grandkids,” Laura Beamer added.

#7

Image credits: thyis1

#8

Image credits: mustardpaws

Another crucial point about student loan borrowers is that not all loans are equal. The economist Steven Deller from the University of Wisconsin Madison argues that “There is a huge difference between someone who assumes a lot of debt and gets an MBA from Harvard or a medical degree from Columbia University, and ... a first-generation student who’s coming from a poor family background and goes into debt and doesn’t complete their degree.”

#9

Image credits: Pale-Yam8117

#10

Image credits: Einteiler

These two individuals are words apart, and while for one, the student debt doesn’t feel like a big deal with a successful career prospect and stable financial background which comes from the family, the other is likely to carry the same burden throughout life, hoping for a cash windfall one day.

#11

Image credits: LordBanaenae1

#12

Image credits: imgur.com

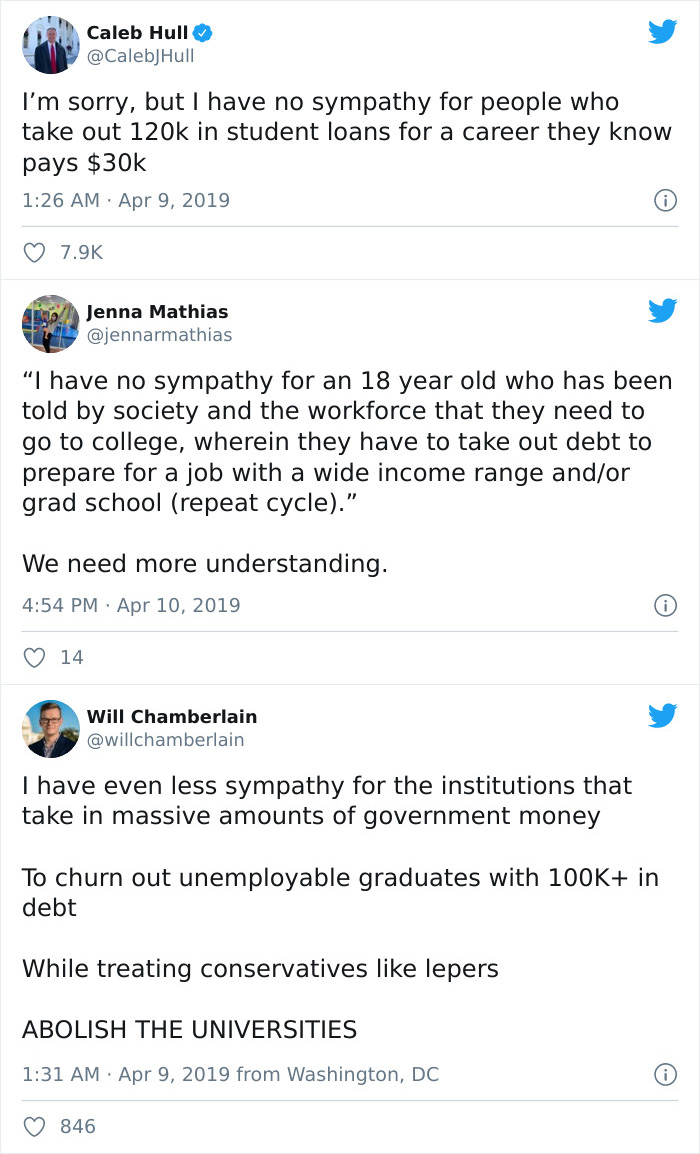

#13

Image credits: CalebJHull

#14

Image credits: AdamLon00077463

#15

Image credits: willchamberlain

#16

Image credits: cubansbottomdollar

#17

Image credits: idiotsaysthis

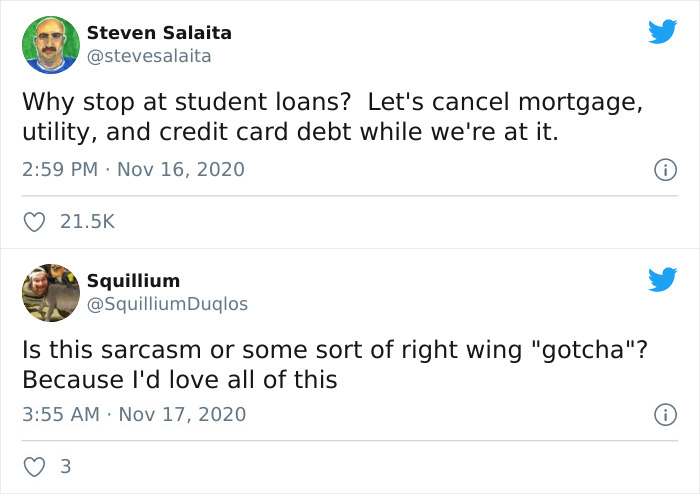

#18

Image credits: SquilliumDuqlos

#19

Image credits: Elizabeth_91

#20

Image credits: WingedMarauder

#21

Image credits: pamajo17

#22

Image credits: _oliviagrace

#23

Image credits: angryblkhoemo

#24

Image credits: madamemodest

#25

Image credits: Inevitable_Professor

#26

Image credits: KrangTNelson

#27

Image credits: Bottyboi69

#28

Image credits: loganalIred

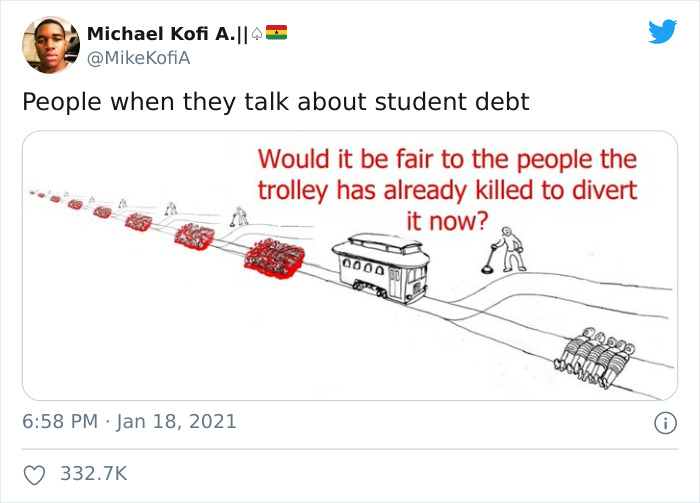

#29

Image credits: MikeKofiA

#30

Image credits: blupanan

#31

Image credits: CAllD2B

#32

Image credits: rnaleli

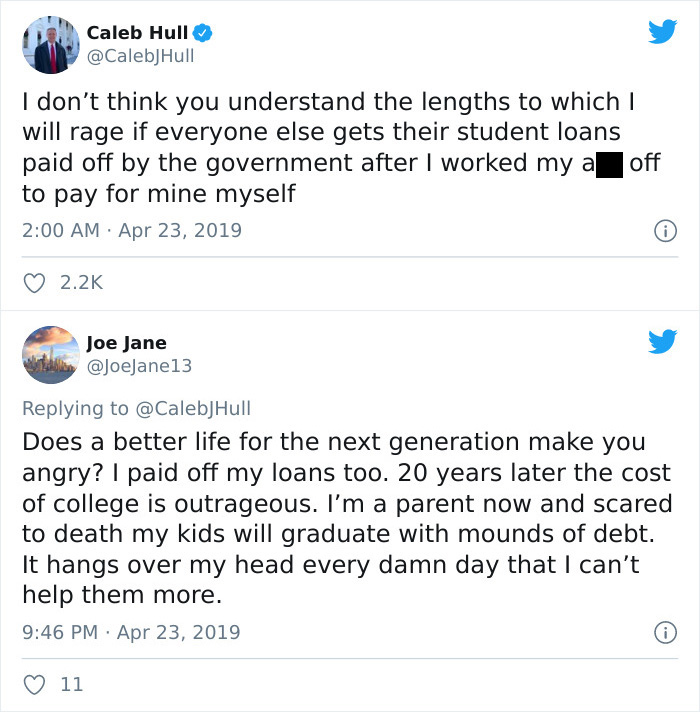

#33

Image credits: JoeJane13

#34

Image credits: imgur.com

#35

Image credits: AlejandroAr3nas

#36

Image credits: Why0_0

#37

Image credits: Social_History

#38

Image credits: victorthigpen24

#39

Image credits: LITTLEWASCHBAR

#40

Image credits: PM_me_ur_lockscreen

#41

Image credits: Active-Ad-233

#42

Image credits: suziesaturn

#43

Image credits: Qeweyou

#44

Image credits: diedtowin

#45

Image credits: ZildjianCymru

#46

Image credits: Emgk2

#47

Image credits: lrlOurPresident

#48

Image credits: SouthSideSigma

#49

Image credits: huff67

#50

Image credits: Hueys69

#51

Image credits: BirdIsTheWorldTruly

#52

Image credits: lrlOurPresident

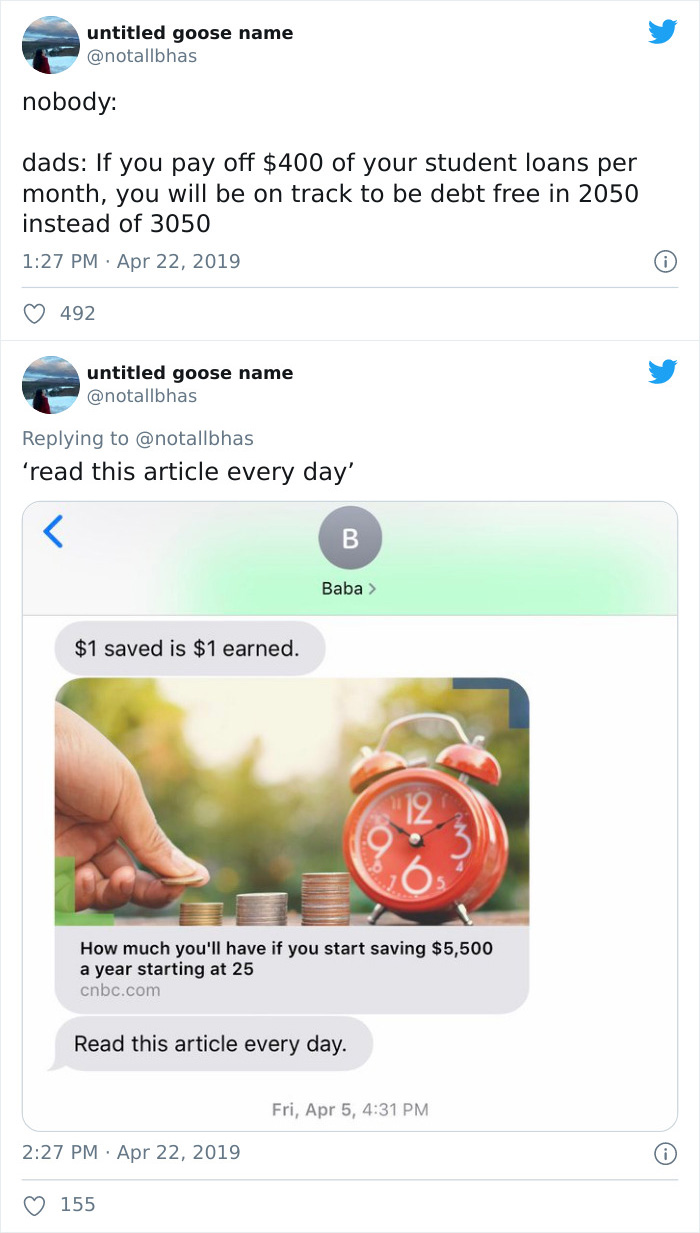

#53

Image credits: notallbhas

#54

Image credits: burgerdrome

#55

Image credits: newbury_eric

#56

Image credits: shanselman

#57

Image credits: dumb_birdDee

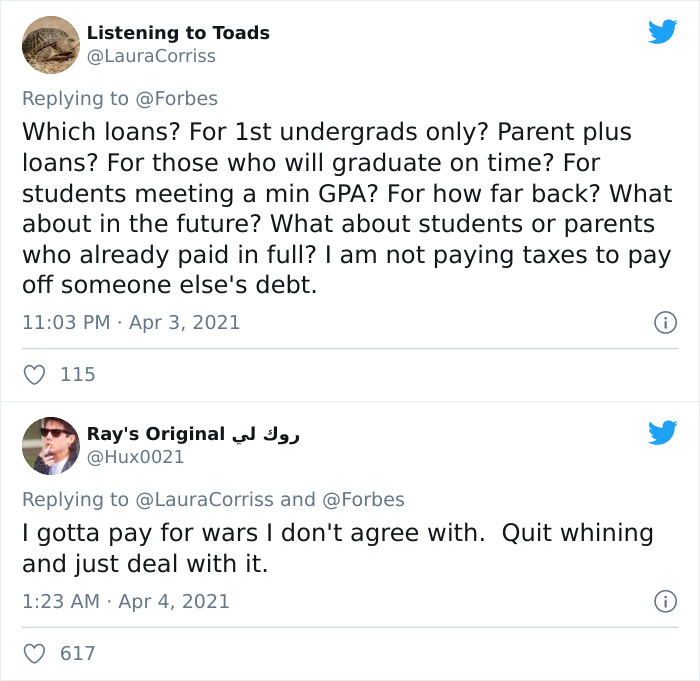

#58

Image credits: Hux0021

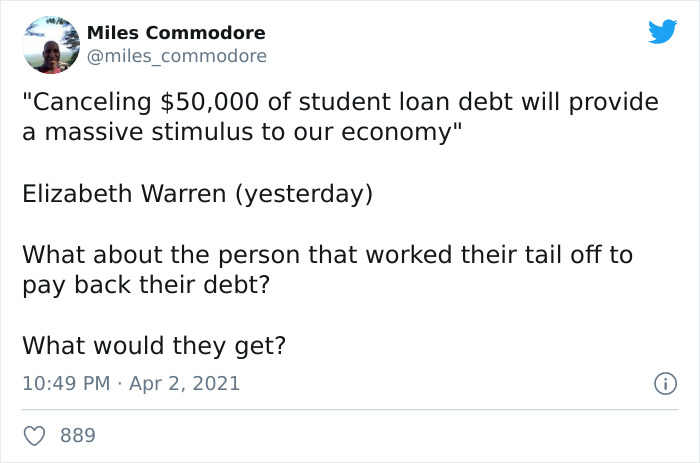

#59

Image credits: miles_commodore

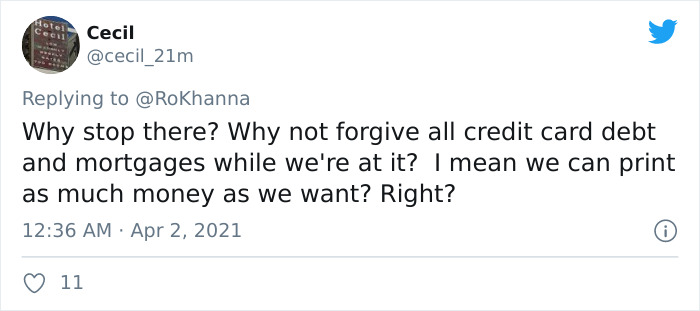

#60

Image credits: cecil_21m

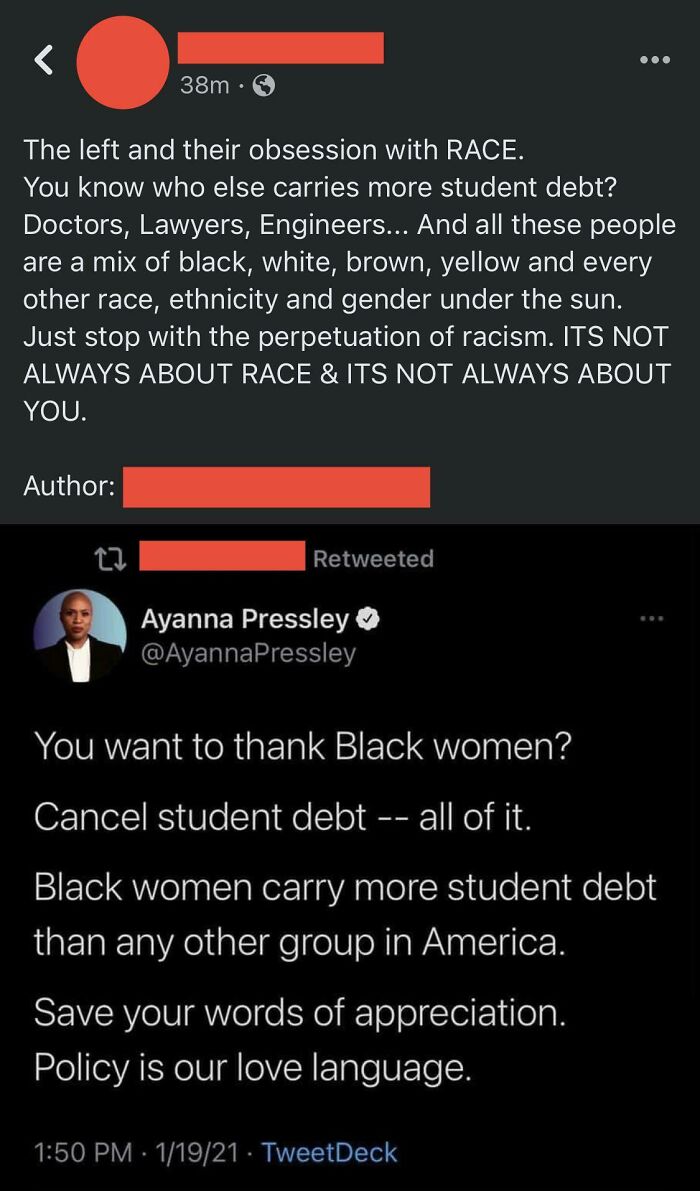

#61

Image credits: Beematic83

#62

Image credits: GoldenNuggiess

#63

Image credits: wizrdmusic

#64

Image credits: itsagummybear

#65

Image credits: whenthewindupbird

#66

Image credits: jadondrew

#67

Image credits: asriel121

#68

Image credits: hcar98

from Bored Panda https://bit.ly/3sVdjEi

via Boredpanda