The ‘American Dream’ rides largely on the idea that you can pull yourself up by your bootstraps and find success, but the reality that many Americans find themselves proves that it’s not that easy. In a long heartfelt Tumblr post user rrojasandribbons described a conversation they had had with one of their more privileged friends on why it was so difficult to escape poverty.

The friend could not believe that the poster had experienced such hardship before, as they didn’t fit the image of what poor people look like, or understood why they couldn’t have just “save money” to get out of it. Scroll down below to read this thorough and thoughtful explanation of the reality of escaping the poverty cycle.

Poverty is defined as when people “lack the means to satisfy their basic needs.” These needs can be explained from a more narrow perspective of what is necessary for survival or in a broader sense the ability to maintain the standard of living for one’s community. A cycle of poverty is when a family remains poor for three or more generations.

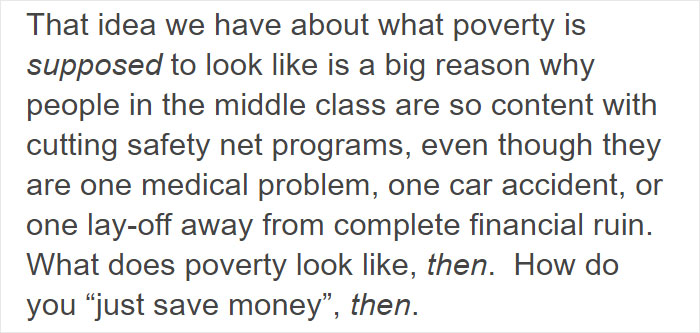

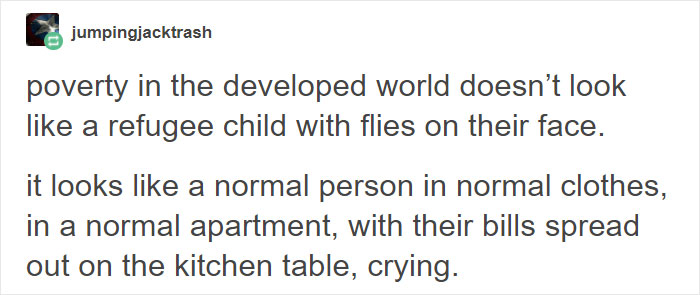

When people imagine poor people much of the time they have a caricature of a dirty face with ripped clothing, living in the city, but if you look at the data this image falls completely out of line with the full picture. In 1960 Lyndon Johnson declared a war on poverty that focused resources on inner city and rural areas, but in 2000 there was a geographical shift of poverty – to the suburbs.

According to a May report from the Pew Research Center, in the U.S suburban counties have experienced sharper increases in poverty than urban or rural counties since 2000. This change makes suburbanization of poverty one of the most important demographic trends within the last 50 years. Unfortunately, suburbs lack the same resources to respond to the growing poverty that the cities do.

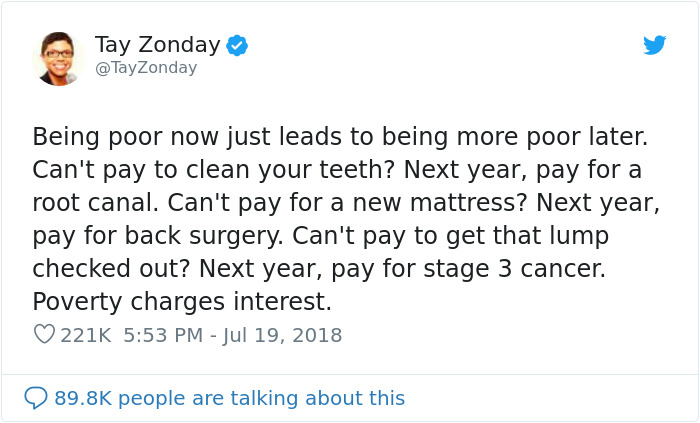

Necessary life expenses can be debilitating when you are living in the poverty cycle – especially medical ones. To put it in perspective the cost for insulin, the shot for people with diabetes, doubled from 2012 to 2016 from $2,864 annually to $5,705. Meanwhile, the Canadian Diabetes Association (CDA) found that on average, Canadians spend more than $1,500 Cdn per year on diabetes medications, devices, and supplies.

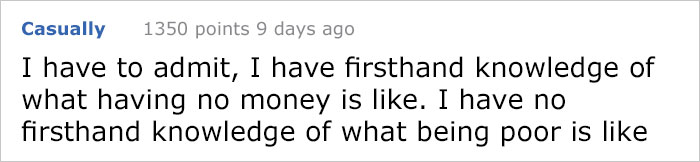

Other people online have echoed this message before

Image credits: TayZonday

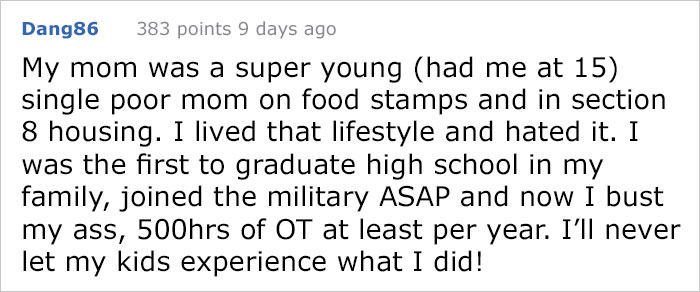

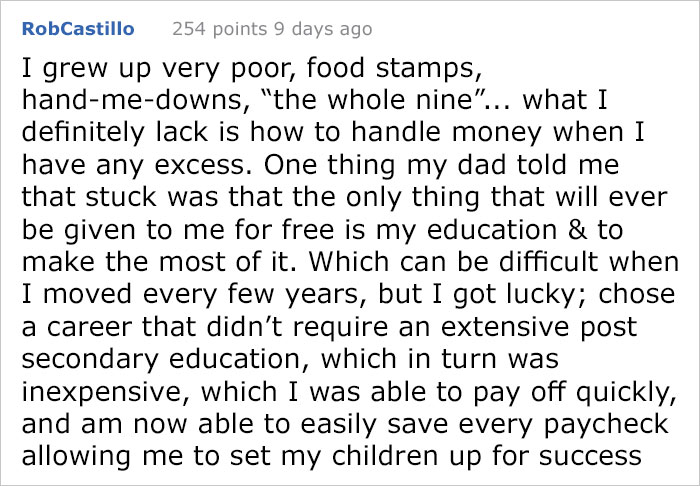

And shared their experiences

from Bored Panda http://bit.ly/2TXBKm5

via Boredpanda